YST DAIRY(01431)

Search documents

原生态牧业(01431) - 於二零二五年十一月二十八日举行之股东特别大会投票表决结果

2025-11-28 09:17

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不 負 責,對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明,並 明 確 表 示 概 不 就 因 本 公 告 全 部 或 任 何 部 分 內 容 而 產 生 或 因 倚 賴 該 等 內 容 而 引 致 的 任 何 損 失 承 擔 任 何 責 任。 YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (於百慕達註冊成立的有限公司) (股份代號:1431) 本公司之香港股份過戶登記分處香港中央證券登記有限公司已獲委任並擔任 股 東 特 別 大 會 投 票 事 宜 的 監 票 機 構。 | 普通決議案 | | | | | | | | | | | | (附 註) 票 數(%) | | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | | | | | | | | | | | | 贊 成 | 反 對 | 棄 | 權 | | 批 准、追 二 零 | | 認 | 及 | 確 ...

原生态牧业(01431) - 股份发行人的证券变动月报表截至二零二五年十月三十一日

2025-11-03 03:01

股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年10月31日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 原生態牧業有限公司 呈交日期: 2025年11月3日 I. 法定/註冊股本變動 II. 已發行股份及/或庫存股份變動 | 1. 股份分類 | 普通股 | | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01431 | 說明 | | 普通股 | | | | | | | | 已發行股份(不包括庫存股份)數目 | | | 庫存股份數目 | | 已發行股份總數 | | | 上月底結存 | | | | 4,690,496,400 | | 0 | | 4,690,496,400 | | 增加 / 減少 (-) | | | | 0 | | 0 | | | | 本月底結存 | | | | 4,690,496,400 | | 0 | | 4,690,496,400 | 第 2 頁 共 1 ...

原生态牧业(01431) - 致非登记持有人之通知信函及回条

2025-10-31 08:36

YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (Incorporated in Bermuda with limited liability) ( 在百慕達成立之有限公司) (Stock code / 股份代碼:1431) N O T I F I C AT I O N L E T T E R 通 知 信 函 Dear Non-registered holders(Note) 31 October 2025 YuanShengTai Dairy Farm Limited (the "Company") Notice of Publication of Circular and Notice of Special General Meeting (the "Current Corporate Communications") The Current Corporate Communications of the Company have been published in English and Chinese languages and are available on t ...

原生态牧业(01431) - 致登记持有人之通知信函及回条

2025-10-31 08:35

YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (Incorporated in Bermuda with limited liability) Please note that both the English and Chinese versions of all future Corporate Communications will be available electronically on the websites of the Company at www.ystdfarm.com or www.ystdairyfarm.com and the website of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk in place of printed copies. Solicitation of electronic contact details ( 在百慕達成立之有限公司) (Stock code / 股份代碼:1431) N O T I F I C AT I O N L E T T ...

原生态牧业(01431) - 持续关连交易 - 二零二六年飞鹤主协议

2025-10-31 08:34

日期:2025年9月29日 原生态牧业有限公司YuanShengTai Dairy Farm Limited (代表本身和其他原生态集团成员) (卖方) 及 中国飞鹤有限公司China Feihe Limited (代表本身和其他飞鹤集团成员) (买方) 生鲜乳买卖框架协议 本协议于 2025 年 9 月 29 日(「本协议日」)由下列各方签订: 鉴于: 卖方及买方于 2022 年 10 月 14 日签订生鲜奶买卖框架协议 ·根据该协议 ·卖方(代表其自身及 (A) 其他原生态集团成员)向买方(代表其自身及其他飞鹤集团成员)供应生鲜乳, 协议期限为 3 年 · 至 2025年12月31日终止(「原买卖框架协议」)。 卖方(代表其自身及其他原生态集团成员)同意于原买卖框架协议期限结束后继续向买方(代表其 (B) 自身及其他飞鹤集团成员)供应生鲜乳·并签订本协议。 卖方为一家于联交所主板挂牌的公司(上市编号:1431)·飞鹤集团(包括买方)根据上市规则第 (C) 14A.07 条为卖方的尖连人士。因此·原买卖框架协议及本协议项下拟进行的交易均构成卖方 的尖连交易。 1.1 除文义需另作解释外·下列词语应具如下意义 ...

原生态牧业(01431) - 股东特别大会代表委任表格

2025-10-31 08:33

YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (於百慕達註冊成立的有限公司) (股份代號:1431) 股東特別大會 代表委任表格 地址為 或 如其未克出席則由 (姓名) , 地址為 或 如其未克出席則由大會主席 (見附註2) 為本人╱吾等之代表,代表本人╱吾等及以本人╱吾等之名義出席本公司謹訂於二零 二五年十一月二十八日(星期五)上午十時正假座中國北京朝陽區酒仙橋路22號北京東隅會議室2舉行之股東特別大會(「股東特 別大會」)及其任何續會,並於會上對任何決議案或動議代表本人╱吾等投票。本人╱吾等之代表獲授權依照下列所示 (見附註 3) 就有關之決議案作出投票。除非另有界定,否則本表格所用詞彙定義與本公司日期為二零二五年十月三十一日的通函所界定 者相同。 | | 普通決議案 (見附註3) | 贊成 | 反對 | 棄權 | | --- | --- | --- | --- | --- | | 1. | 批准、追認及確認二零二六年飛鶴主協議及二零二六年飛鶴主協議項下 | | | | | | 擬進行之交易以及相關之截至二零二六年十二月三十一日、二零二七年 | | | | | | 十 ...

原生态牧业(01431) - 股东特别大会通告

2025-10-31 08:32

香港交易及結算所有限公司及香港聯合交易所有限公司對本通告的內容概不 負 責,對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明,並 明 確 表 示,概 不 對 因 本 通 告 全部或任何部份內容而產生或因倚賴該等內容而引致的任何損失承擔任何責 任。 YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (於百慕達註冊成立的有限公司) (股份代號:1431) 股東特別大會通告 – 2 – 「動 議: 代表董事會 原生態牧業有限公司 主 席 張永久 香 港,二 零 二 五 年 十 月 三 十 一 日 – 1 – (a) 批 准、追 認 及 確 認 二 零 二 六 年 飛 鶴 主 協 議 及 二 零 二 六 年 飛 鶴 主 協 議 項 下 擬 進 行 之 交 易(其 註 有「A」字 樣 之 副 本 已 提 呈 大 會,並 由 大 會 主 席 簡 簽 以 資 識 別)以 及 相 關 之 截 至 二 零 二 六 年 十 二 月 三 十 一 日、二 零 二 七 年 十 二 月 三十一日及二零二八年十二月三十一日止年度之建議年度上限分別為人 民 幣3,100百 萬 元、人 民 ...

原生态牧业(01431) - 持续关连交易:二零二六年飞鹤主协议

2025-10-31 08:31

此乃要件 請即處理 閣下對本通函的任何方面或應採取的行動如有任何疑問,應諮詢 閣下的證券經紀或其他持牌證券交易 商、銀行經理、律師、專業會計師或其他專業顧問。 閣下如已售出或轉讓名下所有原生態牧業有限公司股份,應立即將本通函及隨附的代表委任表格送交買主 或受讓人或經手買賣或轉讓的銀行、證券經紀或持牌證券交易商或其他代理商,以便轉交買主或受讓人。 香港交易及結算所有限公司及香港聯合交易所有限公司對本通函的內容概不負責,對其準確性或完整性亦 不發表任何聲明,並明確表示概不就因本通函全部或任何部分內容而產生或因倚賴該等內容而引致的任何 損失承擔任何責任。 (於百慕達註冊成立的有限公司) (股份代號:1431) YuanShengTai Dairy Farm Limited 原生態牧業有限公司 持續關連交易: 二零二六年飛鶴主協議 獨立董事委員會及獨立股東 之獨立財務顧問 董事會函件載於本通函第6頁至第20頁。獨立董事委員會函件載有其致獨立股東的推薦意見,載於本通函第 21頁至第22頁。獨立財務顧問嘉林資本函件載有其致獨立董事委員會及獨立股東的意見,載於本通函第23 頁至第40頁。 原生態牧業有限公司謹訂於二零二五年 ...

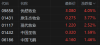

港股异动丨乳制品股反弹 优然牧业涨4% 中国飞鹤涨1.5% 机构指奶价拐点仍可期

Ge Long Hui· 2025-10-28 03:45

Core Viewpoint - The Hong Kong dairy stocks have rebounded after a period of decline, with several companies showing positive price movements, although the overall dairy price remains below cost levels, indicating ongoing industry challenges [1]. Group 1: Market Performance - Yurun Dairy increased by 4%, Ecological Dairy by 3.77%, Modern Dairy by 2.5%, China Shengmu by 1.5%, and China Feihe by 1.46% [2]. - The rebound in stock prices is attributed to pre-holiday inventory buildup and increased demand for student milk production [1]. Group 2: Industry Conditions - Despite the short-term support for milk prices due to holiday factors, the trend of capacity reduction in the dairy industry continues [1]. - The overall milk price remains below the cost line, leading to ongoing industry losses and financial pressures from silage [1]. - The number of dairy cows decreased by 0.18% month-on-month in September, following a 0.2% decline in August, with a cumulative reduction of approximately 8% [1]. Group 3: Future Outlook - The capacity reduction trend may be nearing its end, and a turning point in the milk price cycle is anticipated [1].

原生态牧业(01431) - 延迟寄发通函

2025-10-22 08:34

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不 負 責,對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明,並 明 確 表 示,概 不 對 因 本 公 告 全部或任何部份內容而產生或因倚賴該等內容而引致的任何損失承擔任何責 任。 YuanShengTai Dairy Farm Limited 原生態牧業有限公司 (於百慕達註冊成立的有限公司) (股份代號:1431) 延遲寄發通函 – 1 – 由 於 需 要 更 多 時 間 落 實 該 通 函 內 所 載 的 若 干 資 料,故 本 公 司 預 期 該 通 函 的 寄 發 日 期 將 延 遲 至 二 零 二 五 年 十 月 三 十 一 日 或 之 前。 承董事會命 原生態牧業有限公司 主 席 張永久 香 港,二 零 二 五 年 十 月 二 十 二 日 於 本 公 告 日 期,董 事 會 包 括 三 名 執 行 董 事,即 張 永 久 先 生(主 席 兼 行 政 總 裁)、 陳 祥 慶 先 生(財 務 總 監)及 劉 剛 先 生;三 名 非 執 行 董 事,即 冷 友 斌 先 生、劉 華 先 生 及 蔡 方 良 先 生;以 及 ...