ORIENT CABLE (NBO)(603606)

Search documents

电力设备及新能源行业双周报(2025、10、17-2025、10、30):“十五五”规划建议发布,大力支持新能源行业发展-20251031

Dongguan Securities· 2025-10-31 07:28

Investment Rating - The report maintains an "Overweight" rating for the power equipment and new energy industry [2]. Core Insights - The "14th Five-Year Plan" emphasizes strong support for the development of the new energy industry, aiming to eliminate barriers to a unified national market and enhance the supply of renewable energy [2][36]. - The power equipment sector has shown strong performance, with a year-to-date increase of 46.13%, outperforming the CSI 300 index by 26.43 percentage points [11][12]. - The report highlights the importance of developing new energy systems, improving energy efficiency, and promoting the integration of various energy sources [36][41]. Market Review - As of October 30, 2025, the power equipment industry rose by 4.66% over the past two weeks, ranking third among 31 industries [11]. - The wind power equipment sector decreased by 0.30%, while the photovoltaic equipment sector increased by 5.86% [16][19]. - The top-performing stocks in the power equipment sector included Fangyuan Co., Tongguan Copper Foil, and Penghui Energy, with increases of 46.23%, 36.88%, and 35.39% respectively [20]. Valuation and Industry Data - As of October 30, 2025, the price-to-earnings (P/E) ratio for the power equipment sector was 34.61, with sub-sectors like motors and batteries showing higher valuations [24]. - The report provides detailed valuation metrics for various sub-sectors, indicating significant growth potential in the photovoltaic and battery segments [24]. Industry News - The report discusses the release of the "14th Five-Year Plan" which aims to accelerate the construction of a new energy system and enhance the resilience of the power system [36]. - It also notes the increase in electricity market transactions, with a 9.8% year-on-year growth in traded electricity volume [36]. Company Announcements - The report includes financial performance updates from several companies, such as Guodian Nari achieving a net profit of 4.855 billion yuan, a year-on-year increase of 8.43% [39]. - It highlights the challenges faced by companies like Longi Green Energy, which reported a net loss of 3.403 billion yuan [39]. Investment Recommendations - The report suggests focusing on leading companies benefiting from the growth of new energy storage technologies and smart grid developments [41][42].

东方电缆的前世今生:2025年Q3营收74.98亿行业第十,净利润9.14亿位居榜首

Xin Lang Cai Jing· 2025-10-31 02:58

Core Viewpoint - Dongfang Cable is a leading domestic company in the submarine cable industry, focusing on the research, production, and sales of various cables, with a comprehensive advantage in the entire industry chain [1] Group 1: Business Performance - In Q3 2025, Dongfang Cable achieved a revenue of 7.498 billion yuan, ranking 10th in the industry, while the net profit was 914 million yuan, ranking 1st [2] - The main business composition includes power engineering and equipment cables at 2.196 billion yuan (49.56%), submarine and high-voltage cables at 1.957 billion yuan (44.14%), and marine equipment and engineering operation at 275 million yuan (6.22%) [2] Group 2: Financial Ratios - As of Q3 2025, the company's debt-to-asset ratio was 45.13%, lower than the industry average of 54.36% [3] - The gross profit margin for Q3 2025 was 20.03%, higher than the industry average of 13.49% [3] Group 3: Management and Shareholder Information - The chairman, Xia Chongyao, has a rich background and numerous honors, while the president, Xia Feng, has a master's degree and holds several patents [4] - As of September 30, 2025, the number of A-share shareholders decreased by 20.22% to 28,800, while the average number of circulating A-shares held per shareholder increased by 25.34% [5] Group 4: Market Outlook and Projections - The company is expected to see significant growth in the coming years, with projected net profits of 1.56 billion yuan, 2.02 billion yuan, and 2.37 billion yuan for 2025, 2026, and 2027, respectively, reflecting growth rates of 55%, 29%, and 17% [5] - As of October 23, 2025, the company had an order backlog of approximately 19.551 billion yuan, indicating a solid foundation for future performance [6]

东方电缆_2025 年第三季度业绩良好;海上风电需求增长推动盈利提升

2025-10-31 00:59

Summary of Ningbo Orient Wires & Cables (NBO) Conference Call Company Overview - **Company**: Ningbo Orient Wires & Cables (603606.SS) - **Industry**: Offshore Wind Power and Cable Manufacturing Key Financial Highlights - **3Q25 Net Profit**: Rmb441 million, representing a **53.1% year-over-year (yoy)** increase and a **129.6% quarter-over-quarter (qoq)** increase [1][2][13] - **Revenue**: Rmb3,066 million in 3Q25, up **16.5% yoy** and **34.2% qoq** [2][12] - **Gross Profit Margin**: Increased to **22.3%**, up **1.3 percentage points (ppts) yoy** and **6.6 ppts qoq** [2][13] - **Backlog**: Rmb19.5 billion as of October 18, 2025, with Rmb11.7 billion from submarine and high-voltage land cable orders [3][14] Market Dynamics - **Offshore Wind Demand**: China aims to add at least **15GW of offshore wind capacity annually from 2026 to 2030**, nearly double the average of **8GW per year from 2021 to 2025** [1][4] - **Installed Capacity Targets**: The goal is to reach **1,300GW by 2030**, **2,000GW by 2035**, and **5,000GW by 2060**, significantly higher than previous targets [4] Order and Delivery Insights - **Strong Order Flow**: NBO's backlog increased by **1.1 times yoy** with a significant portion from high-margin products [3][14] - **Delivery Expectations**: Anticipated increased deliveries in **4Q25 and 2026**, including exports for the Inch Cape Offshore wind project in the UK [3][18] Earnings Forecast - **Earnings Revision**: 2025-2027 earnings estimates raised by **4-8%** due to higher submarine cable sales [1] - **Target Price**: Increased to **Rmb81.00/share**, representing a **37% upside** from the current price of **Rmb66.20** [6][9] Additional Insights - **Cost Reduction**: The unit capital expenditure (capex) for offshore wind projects decreased to **Rmb9,000-12,500/kW** in 2024, down from **Rmb9,500-14,000/kW** in 2023 [29] - **Competitive Pricing**: The average levelized cost of electricity (LCOE) for new offshore wind power has reduced to **Rmb0.3/kWh**, making it competitive with market tariffs [29] Conclusion - NBO is positioned to benefit from the accelerating demand for offshore wind power in China, supported by a robust order backlog and favorable market conditions. The company's financial performance in 3Q25 reflects strong growth, and future earnings are expected to improve further due to increased submarine cable sales and project deliveries.

短线防风险 141只个股短期均线现死叉

Zheng Quan Shi Bao Wang· 2025-10-30 07:13

Core Points - The Shanghai Composite Index is at 4009.81 points with a decline of 0.16% and total A-share trading volume of 203.47 billion yuan [1] - A total of 141 A-shares have seen their 5-day moving average cross below the 10-day moving average, indicating potential bearish trends [1] Group 1: A-Shares with Significant Moving Average Cross - Qiming Information (002232) has a 5-day moving average of 20.42 yuan, down 1.40% from the 10-day moving average of 20.71 yuan, with a current price of 19.70 yuan, which is 4.88% below the 10-day average [1] - Deep Sea (000058) shows a 5-day moving average of 10.11 yuan, down 1.38% from the 10-day average of 10.26 yuan, with a current price of 9.86 yuan, 3.86% below the 10-day average [1] - Dayilong (002209) has a 5-day moving average of 14.42 yuan, down 1.16% from the 10-day average of 14.59 yuan, with a current price of 13.57 yuan, 6.96% below the 10-day average [1] Group 2: Additional A-Shares with Moving Average Cross - Kailong Co. (002783) has a 5-day moving average of 9.91 yuan, down 1.15% from the 10-day average of 10.03 yuan, with a current price of 9.67 yuan, 3.54% below the 10-day average [1] - Blue Communication (688332) shows a 5-day moving average of 144.42 yuan, down 1.11% from the 10-day average of 146.03 yuan, with a current price of 138.03 yuan, 5.48% below the 10-day average [1] - Ocean King (002724) has a 5-day moving average of 7.53 yuan, down 1.10% from the 10-day average of 7.62 yuan, with a current price of 7.11 yuan, 6.67% below the 10-day average [1]

国信证券晨会纪要-20251030

Guoxin Securities· 2025-10-30 02:17

Macro and Strategy - The macroeconomic analysis indicates a significant deviation between traditional GDP calculations and official figures, suggesting a structural transformation in the economy, moving away from traditional infrastructure and real estate investments [9][10] - The focus of future policies is expected to shift from "investment in objects" to "investment in people," emphasizing urban renewal and service industry development [10] Industry and Company Analysis - New Hope Liuhe (002001.SZ) reported a resilient performance with a 5.45% year-on-year increase in revenue to 16.642 billion yuan and a 33.37% increase in net profit to 5.321 billion yuan for the first three quarters of 2025 [20] - Cloud Map Holdings (002539.SZ) experienced a slight revenue decline of 4.73% in Q3, but the core business remains stable with a net profit of 1.64 billion yuan [23] - Kingfa Sci. & Tech. (600143.SH) achieved a 22.62% increase in revenue to 49.616 billion yuan and a 55.86% increase in net profit to 10.65 billion yuan for the first three quarters of 2025, driven by product structure optimization [26] - Aiwai Electronics (688798.SH) reported a 55% increase in net profit for the first three quarters, with a revenue of 2.176 billion yuan, reflecting strong performance in the consumer electronics sector [30] - The overall performance of the food industry, including companies like Sanquan Foods (002216.SZ) and Haitian Flavoring (603288.SH), shows a trend of revenue stabilization and cost control despite market challenges [8][30] Fixed Income Strategy - The convertible bond market is experiencing a significant increase in public fund holdings, with a total of 316.6 billion yuan, despite a decrease in overall market size [12][13] - The strategy suggests a focus on sectors like lithium batteries, semiconductors, and pharmaceuticals for potential high returns, while advising caution in financial and consumer sectors [11][12] Commodity Market Insights - The gold market is witnessing a pivotal moment as prices approach 4400 USD/oz, indicating a challenge to the dollar's dominance and a potential shift in global reserve currency dynamics [18][19] - The fertilizer market, particularly for compound fertilizers, remains stable, although sales have been impacted by extreme weather conditions [24][25]

2025年中国核电站电缆行业政策、产业链图谱、运行现状、重点企业布局及未来发展趋势研判:核电站迎来规模化建设机遇,核级电缆开启增量扩容新周期[图]

Chan Ye Xin Xi Wang· 2025-10-30 01:07

Core Insights - The nuclear power cable industry is crucial for the safe and stable operation of nuclear power plants, designed to meet extreme performance requirements such as high temperature resistance, radiation resistance, and low smoke halogen-free flame retardancy [1][6][3] - China's nuclear power sector is a key support for energy structure transformation and achieving carbon neutrality goals, with a national strategy focused on the "active, safe, and orderly development of nuclear power" [1][6] - The industry is entering a high prosperity cycle driven by policies, market demand, and technological advancements, with a significant market expansion expected [1][9] Industry Overview - Nuclear power cables are specifically designed for the unique environments of nuclear power plants, requiring high insulation, temperature, radiation, and corrosion resistance [2][3] - The cables play a core role in power transmission, signal control, and system safety, making them essential components for stable power system operation [2][6] Policy Environment - The Chinese government has set ambitious targets for nuclear power capacity, aiming for 70 million kilowatts by 2025 and 131 million kilowatts by 2030, with ongoing approvals for advanced reactor projects [6][9] - Recent policies have been introduced to support the nuclear industry across various dimensions, including development planning, safety assurance, and market access [6][9] Industry Chain - The upstream of the nuclear power cable industry includes suppliers of metals and insulation materials, with domestic companies like Jiangxi Copper and China Aluminum being significant players [7] - The midstream consists of cable manufacturing, dominated by companies such as Jiangsu Shangshang Cable and Far East Group, indicating a high market concentration [7] - The downstream includes nuclear power plant construction units and equipment manufacturers, driving continuous demand for cable products [7] Current Development Status - China's nuclear power sector has seen rapid growth, with 58 operational nuclear reactors and a total installed capacity of 60.88 million kilowatts as of 2024, ranking third globally [8][9] - The industry is expected to see a market scale exceeding 3 billion yuan in 2024, with projections of reaching 3.44 billion yuan by 2025, reflecting a robust annual growth rate of approximately 12% [9][10] Competitive Landscape - The industry is characterized by a few leading domestic companies that dominate the market, such as Anhui Cable and Jiangsu Shangshang Cable, which have achieved breakthroughs in high-end product localization [10] - Other notable companies include Baosheng Co., Shangwei Co., and Hualing Cable, which contribute to the competitive landscape with their specialized cable products [10] Future Development Trends - The industry is expected to evolve through technological innovation, market expansion, and global positioning, focusing on high-end materials and smart monitoring technologies [11][12] - New application scenarios are emerging, including small modular reactors and nuclear hydrogen production, which will drive demand for specialized cables [12] - Chinese companies are anticipated to accelerate their global presence, leveraging the Belt and Road Initiative to enhance their international competitiveness [13]

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

东方电缆(603606):重点项目交付提振业绩,订单结构持续升级

Guoxin Securities· 2025-10-29 06:44

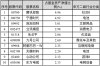

Investment Rating - The investment rating for the company is "Outperform the Market" [5][26][30] Core Views - The company's performance remains robust in the first three quarters, with a revenue of 7.498 billion yuan, a year-on-year increase of 11.93%, and a net profit of 914 million yuan, a slight decrease of 1.95% year-on-year. The gross margin is 20.03%, down 2.13 percentage points year-on-year [8][20] - Significant growth was observed in the third quarter, driven by the delivery of high-value projects in Guangdong. The company achieved a revenue of 3.066 billion yuan in Q3, up 16.55% year-on-year and 34.16% quarter-on-quarter, with a net profit of 441 million yuan, up 53.12% year-on-year and 129.63% quarter-on-quarter [20][23] - The company has a strong order backlog of approximately 19.551 billion yuan, with 11.737 billion yuan in underwater and high-voltage cable orders, indicating a continuous optimization of the order structure [23][24] Summary by Sections Financial Performance - In the first three quarters, the company reported a revenue of 74.98 billion yuan, with a net profit of 9.14 billion yuan. The gross margin was 20.03% and the net margin was 12.19% [8][20] - For Q3, the revenue was 30.66 billion yuan, with a net profit of 4.41 billion yuan, resulting in a gross margin of 22.60% and a net margin of 14.38% [20][23] Order and Project Updates - The company has secured underwater and high-voltage cable orders totaling 11.737 billion yuan, with a total order backlog of 19.551 billion yuan as of October 23, 2025 [23][24] - Recent project wins include high-specification underwater cables for offshore wind power projects, indicating a favorable trend in order acquisition [23][24] Future Outlook - The company is strategically positioning itself in the deep-sea offshore wind power sector, with plans to develop a total capacity of over 3 million kilowatts by 2030 [24] - The company is also advancing its technology with the development of ±800kV DC cables, achieving international leading standards for its 500kV AC and DC underwater cables [24][26]

风机大型化节奏明确放缓,十五五规划建议点名氢能“未来产业”

Ping An Securities· 2025-10-28 07:15

Investment Rating - The report maintains an "Outperform" rating for the industry [1] Core Insights - The pace of wind turbine large-scale development is clearly slowing down, with a focus on hydrogen energy as a "future industry" in the 14th Five-Year Plan [1][7] - The wind power index increased by 5.91%, outperforming the CSI 300 index by 2.66 percentage points [4][12] - The overall PE ratio for the wind power index is 25.72 times [12] Summary by Sections Wind Power - The recent Beijing International Wind Energy Conference showcased few new products, with a trend towards standardizing rotor diameters rather than further increasing size [6][11] - The domestic wind turbine market is expected to stabilize, with a focus on international expansion, leading to a gradual recovery in profitability for wind turbine manufacturers by 2026 [6][11] - The wind power index's performance indicates a strong market sentiment, with a year-to-date increase of 40.03% [12][13] Photovoltaics - Tongwei's Q3 earnings showed significant improvement, with a revenue of 24.09 billion yuan, a year-on-year decrease of 1.57%, and a net loss reduction of 5.29 billion yuan [6][4] - The overall PE ratio for the photovoltaic sector is approximately 44.31 times, indicating a high valuation despite short-term supply-demand challenges [4][12] Energy Storage & Hydrogen Energy - The 14th Five-Year Plan emphasizes hydrogen energy as a key future industry, highlighting its potential for significant market growth [7] - The report suggests that the hydrogen energy sector is gaining policy support, with expectations for orderly project implementation across the entire industry chain [7] - Investment opportunities are identified in companies focusing on green hydrogen project investment and operation [7] Investment Recommendations - For wind power, the report recommends focusing on domestic offshore demand, profitability recovery, and international expansion opportunities, highlighting companies like Mingyang Smart Energy and Goldwind [7] - In photovoltaics, attention is drawn to structural opportunities within the industry, with recommended stocks including Dier Laser and Longi Green Energy [7] - In energy storage, the report suggests looking at companies with strong global competitiveness and low valuations, such as Sungrow Power Supply [7]

东方电缆(603606)2025年三季报点评:25Q3营收净利双增 持续斩获高电压海缆订单

Xin Lang Cai Jing· 2025-10-27 12:34

Core Viewpoint - The company reported a mixed financial performance for Q3 2025, with revenue growth but a slight decline in net profit year-on-year, indicating a strong operational performance despite challenges in profitability [1][2]. Financial Performance - For the first three quarters of 2025, the company achieved revenue of approximately 7.498 billion yuan, a year-on-year increase of 11.93%, while the net profit attributable to shareholders was about 914 million yuan, a decline of 1.95% [1]. - In Q3 2025, the company recorded revenue of 3.066 billion yuan, representing a year-on-year growth of 16.55% and a quarter-on-quarter increase of 34.16% [1]. - The gross margin for Q3 2025 was approximately 22.60%, up 6.35 percentage points quarter-on-quarter and 0.86 percentage points year-on-year, while the net margin was about 14.38%, up 5.98 percentage points quarter-on-quarter and 3.43 percentage points year-on-year [1]. Business Segmentation - In the first three quarters of 2025, the company generated revenue of 3.536 billion yuan from power engineering and equipment cables, accounting for approximately 47.54% of total revenue [1]. - Revenue from submarine cables and high-voltage cables was 3.549 billion yuan, representing about 47.71% of total revenue, while marine equipment and engineering operations generated 353 million yuan, accounting for approximately 4.75% [1]. Order Backlog and Growth - As of October 23, 2025, the company had an order backlog of approximately 19.551 billion yuan, with significant contributions from power engineering and equipment cables, submarine cables and high-voltage cables, and marine equipment and engineering operations [2]. - Recent high-voltage submarine cable orders include projects for Zhejiang Energy and China Energy Construction, indicating a strong demand for high-voltage solutions [2]. Capacity Expansion - The company is enhancing its capacity by participating in the Zhejiang Offshore Wind Port project, aimed at supporting deep-sea wind power construction, with plans to achieve a total installation capacity of over 3 million kilowatts by 2030 [3]. - Ongoing projects include the construction of a central research institute and the second phase of the future factory, which will improve production capacity and support the establishment of northern and southern industrial bases [3]. Investment Outlook - Revenue projections for 2025-2027 are estimated at 10.97 billion, 13.97 billion, and 15.16 billion yuan, with net profits expected to be 1.42 billion, 2.33 billion, and 2.54 billion yuan respectively, indicating a favorable growth trajectory [3].